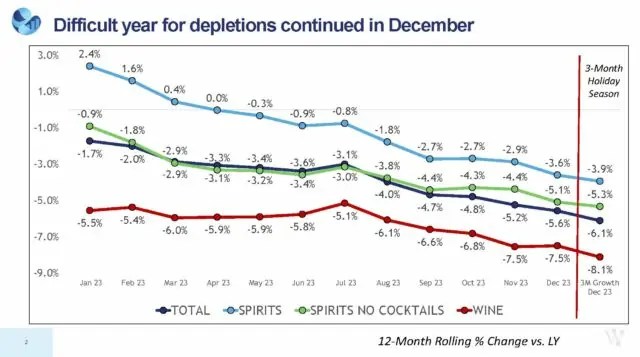

Things Are Going to Get Worse Before They Get Better (Thoughts on SipSource’s 2023 Wine Data)

Looks like things are going to get (even) worse for the global wine industry before they get better.

My friend Jeff Siegel recently reported on wineindustryadvisor.com about the release of 2023 wine sales data from SipSource (owned by the Wine & Spirits Wholesalers Association), in a piece titled More Bad News: SipSource Report Pulls No Punches. The numbers paint a picture of wine’s global position that can probably best be described as at least somewhat grim.

While I love Jeff’s writing, in this case as a wine lover I suggest that you not read his article unless you want to feel really, really, sad. Here’ an excerpt (emphasis is mine):

“Wine ended 2023 with one of its worst holiday performances in recent memory, seeing sales drop 8.1% in the final three months compared to the same timespan in 2022. That was even worse than its overall performance last year, a 7.5% decline in volume. The gloomy news continued in January, according to figures released March 4. Wine on-premise declined 5.4%, two percentage points lower than the December data, while off-premise wine dropped 8.4%, one-half a percentage point lower than the previous period. There were also losses in table wine across all prices, though the smallest decline came at bottles priced $11-$14.99, down -4.7%.”

In other words, we’re measuring success in terms of the least amount of blood lost in the carnage.

Jeff goes on to point out that “the SipSource data jibes with similar surveys from Nielsen (2023 down 4% from 2022) and BW166 (down 7.6%) for all of last year,” and that the numbers “tell a story of wine’s continuing decline, and provide little hope for a quick turnaround.”

It’s that last bit (emphasis also mine) that’s the salient point here.

Adding insult to injury in a way is some reporting from another friend of mine (Blake Gray) on recent data from the Wine Market Council (helmed by another friend of mine, Dr. Liz Thach, and yes, the wine world really is this small), showing that declining sales are now hitting even the price-points that were recently the lone bright spots for the wine business:

“Wines above $15 were growing in sales until last year. But suddenly in 2023, sales of wine over $50 dropped 11.7 percent and sales of wine from $25-$50 dropped 15.4 percent. Even the safest price category, $15 to $25, dropped 5 percent… Even Sauvignon Blanc finally started dropping. And rosé, the last Next Big Thing, dropped faster than everything else.”

You will be seeing lots of people offering somewhat more positive spins on wine’s current sales situation, and most of them will be doing so because their jobs at least partially depend on putting a positive spin on wine’s current sales situation. But the reactions of the industry sure don’t make it feel like the turnaround is going to be fast: dumping millions of liters of wine on the cheap (potentially impacting future bottle prices), ripping out vines, and ripping out even more vines.

Of course, those are drastic enough measures that they are making mainstream news, which in turn will underscore the desperation of wine industry’s current scenario even more emphatically in the public consciousness. Maybe we can rely on the speed of the current news cycle and the short attention spans of the general populace to mitigate that mindshare damage, but I doubt it (especially given the negative news bias in the media, which will likely ensure that promotion of a more positive take on wine’s future resurgence comes very, very slowly).

Hold on to your hats, because the numbers strongly suggest that we have yet to hit bottom on this.

Cheers!